Stock Market Review-Alerts – McClellan Oscillator – Summation Index – Chande Momentum Oscillator – Stochastic Oscillator – Market Bias

Cell Phones & Navigating this site

The Valuator is a free subscription

The Valuator is a free subscription

Time where this site is managed

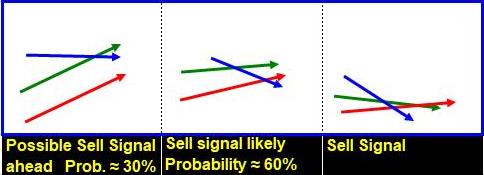

Look for These Configurations

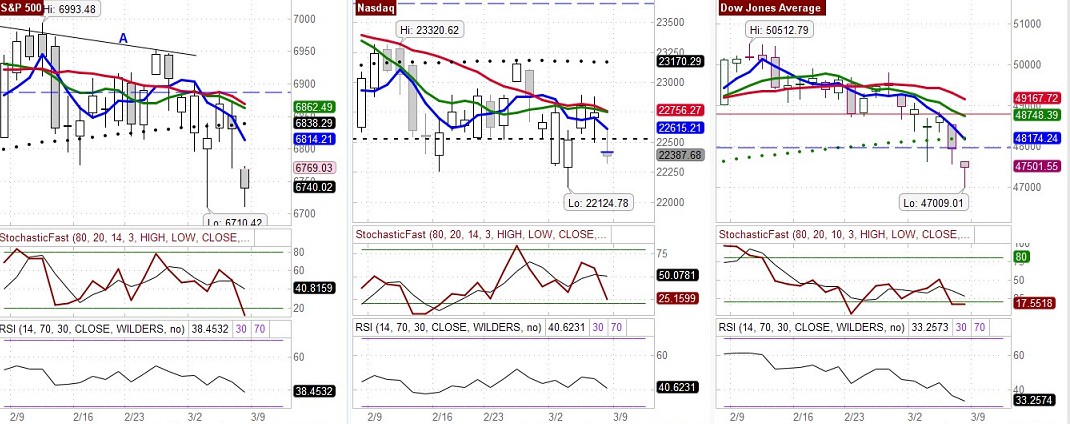

The above charts show the moving averages used with R.C. Allen’s trading system.

The above charts show the moving averages used with R.C. Allen’s trading system.

R.C. Allen’s Explanation of His System

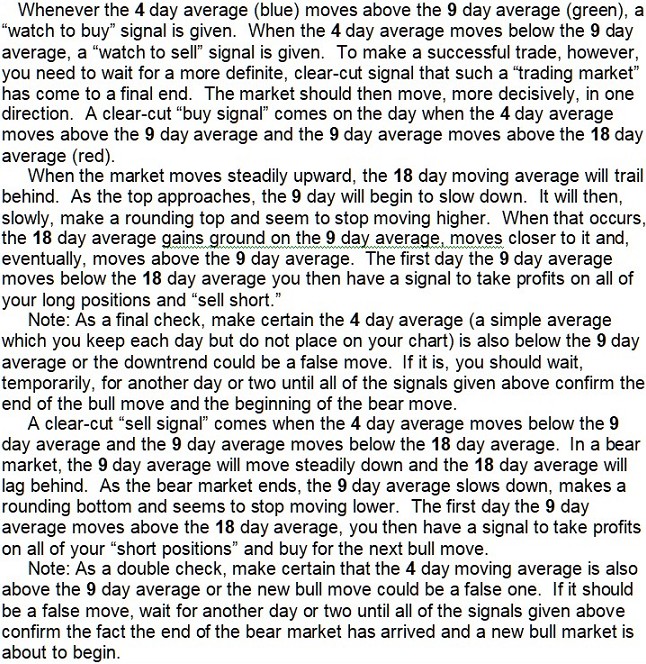

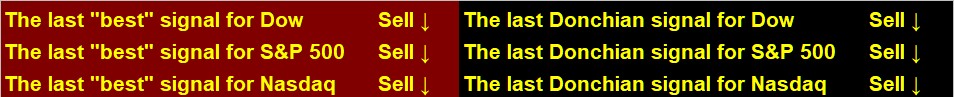

Here Are The Signals of Two Other Systems

See also Donchian’s dual crossover system

See also Donchian’s dual crossover system

R.C. Allen’s Triple crossover System

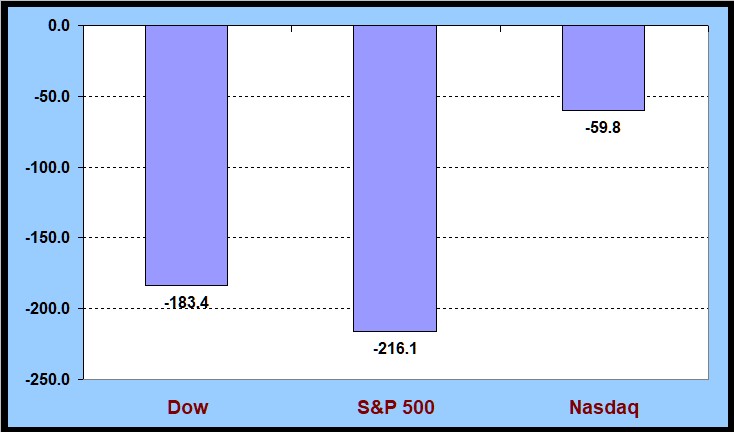

Friday, March 5, 2026 (after close)

The Dow last closed at 47501.55, down -453.19 points or -0.95%, the S&P 500 last closed at 6740.02 down, -90.69 points or -1.33%, and the Nasdaq Composite Index last closed at 22387.67 down, -361.3068 points or -1.59%.

Key Intraday Levels: PAL estimates that if a stock benchmark is above its indicated target level for more than 30 minutes of the first hour of trading, that benchmark has a very high probability of closing higher. The bullish target value for the Dow is 47,777. The bullish target for the S&P 500 is 6,776. The bullish target for the Nasdaq Composite Index is 22,520. On the other hand, if a stock benchmark is below its estimated bearish target level for more than 30 minutes of the first hour of trading, that benchmark has a very high probability of closing lower. The bearish target value for the Dow is 47,226. The bearish target for the S&P 500 is 6,704. The bearish target for the Nasdaq Composite Index is 22,256.

The House of Representatives rejected an effort on Thursday to stop President Trump’s air war on Iran and require that any hostilities against Iran be authorized by Congress, backing the Republican president’s military campaign. The vote was 219 to 212, largely along party lines, in the House. Two Republicans voted in favor of the resolution and four Democrats voted against it. Opponents accused Democrats of taking the issue to a vote only because they oppose Trump. “We all know that we wouldn’t be here today if the president’s name wasn’t Donald Trump,” Representative Rick Crawford of Arizona, the Republican chairman of the House Intelligence Committee, said during debate on Wednesday. The War Powers Resolution of 1973 measure requires unauthorized military actions to be terminated within 60 days, giving the Trump administration a deadline at the end of April to seek Congress’ approval.

Iranian Kurdish militias have consulted with the United States about whether, and how, to attack Iran’s security forces in the western part of the country. The Iranian Kurdish coalition of groups based on the Iran-Iraq border has been training to mount such an attack in hopes of weakening the country’s military, as the United States and Israel pound Iranian targets with bombs and missiles.

U.S. futures and European stocks fell on Friday as oil prices rose to their highest level in almost two years, prompting traders to reduce their bets on interest rate cuts and worry about prospects for economic growth. Qatar expects all Gulf energy producers to shut down exports within weeks, lifting oil prices to $150 a barrel, the country’s energy minister told the Financial Times in an interview published on Friday.

U.S. crude oil prices jumped more than 5% to $86.70 a barrel, the highest since April 2024. Brent crude also rose to its highest in nearly two years at $89.50 a barrel. Data on Friday showed U.S. non-farm payrolls fell by 92,000 in February, after a rise of 126,000 in January. The unemployment rate rose to 4.4%, compared to 4.3% in January.

President Trump demanded Iran’s “unconditional surrender” on Friday. Trump made the remarks on social media just hours after Iran’s president announced that several countries had begun mediation efforts, possibly a sign of a diplomatic initiative to end the conflict, as Israel launched fresh attacks on Iran and Lebanon and Iran sent missiles into Israel and Gulf states that host U.S. military bases. “There will be no deal with Iran except UNCONDITIONAL SURRENDER!” Trump said. “After that, and the selection of a GREAT & ACCEPTABLE Leader(s), we, and many of our wonderful and very brave allies and partners, will work tirelessly to bring Iran back from the brink of destruction, making it economically bigger, better, and stronger than ever before.” The surrender demand, and the probability that this would make unlikely any quick path to ending the war, caused immediate shock in financial markets. European stock markets, open at the time of Trump’s post, plunged.

resident Trump said Iran would be “hit very hard” today (Saturday) and that he was considering widening the areas and groups of people being, targeted, without providing details. “Today Iran will be hit very hard! Under serious consideration for complete destruction and certain death, because of Iran’s bad behavior, are areas and groups of people that were not considered for targeting up until this moment in time”

Group Pressure Gradient The market has an effect on shares analogous to the effect of air currents on an airplane. The greater the speed of the wind against the direction of the plane, the more difficult it is for a plane to make headway. However, a plane moving in the direction of the wind will find it much easier to make headway and to gain speed. An airplane has its own driving force, but the plane’s environment exerts its external force on the plane. Likewise, shares have their own motion based on supply/demand and sentiment considerations pertaining to those shares, but the environment in which the shares exist exerts forces on the shares that are unrelated to the merits of specific shares within that environment. We refer to this “force” as the “Group Pressure Gradient.” A Group Pressure Gradient reading near zero might be compared to flying on a windless or near windless day, and a reading of 28 might be compared to flying with a gentle to moderate tail wind. To continue the analogy, let’s assume we are dealing with a scale ranging from -100 to +100. Then, a reading of 28 to 57 might be compared to flying with a moderate to strong tail wind, while a reading of 57 to 85 would be like flying with strong winds to gale level tail winds. Negative readings would reverse the above comparisons. Of course the analogy is not perfect because a pilot would not want to fly in gale winds, but we certainly would not mind investing in shares when the market is registering 57 to100 on the pressure gradient scale. Note: By the time you read this, we will be using raw scores, so readings will no longer be confined to a scale with boundaries between -100 and +100. The Group Pressure Gradient has both magnitude and direction. Hence, it is a vector. A river or stream has many currents, cross-currents, counter-currents, eddies, and minor whirlpools. If a person wants to know what the pressure gradients are in a stream, he must select a specific spot in the stream to conduct his measurements. The same thing applies to pressure gradients in the stock market. To measure a pressure gradient, it is necessary to select a specific group of stocks within the market. We are currently calculating this indicator for three groups of stocks: stocks in the Dow, stocks included in the Nasdaq Composite Index, and stocks that make up the S&P500 index (the last time we checked, the S&P500 consisted of 50.8% mid-cap, 45.4% large-cap, and the rest were small-cap). Measurements are not made for individual stocks in isolation. It is the general environment of the stocks in these groups that is being measured. Please be aware that some big-cap blue-chip stocks are in all three of our benchmarks (the Dow, in the S&P500, and on the Nasdaq), and each grouping has its own group pressure gradient. Therefore, when a stock is in more than one group, it is best to consider each environment but give the strongest weighting to that of the Dow (because the Dow has the greatest relative concentration of investors in blue-chips who also represent the biggest relative concentration of big money). If you are not investing in blue-chips, then you might give more weighting to the S&P 500. If you are investing in a portfolio of technology stocks, then give emphasis to the reading for the Nasdaq. Usually the groups have similar readings, but sometimes they are quite different. The GPG of a group may decline while the corresponding Index rises, or rise wile the corresponding Index declines. Also, individual stocks within a group can surge (because of a news event, for example), even when there is a negative pressure gradient. The indicator is extremely sensitive and can change dramatically from day to day. It might be best to think of it as measuring the current status of the pressure gradient. Earlier, we gave the analogy of an airplane flying with or against the wind. Bear in mind that air currents are constantly shifting in direction and intensity. An airplane often encounters gusts of wind. Similarly, this indicator will occasionally reflect “gusts” and reversals. In other words, the indicator can sometimes be volatile on a daily basis. After observing it for a few days, a general pattern may emerge. It may become evident that the indicator tends to show pressures more often in one direction than in the opposite direction. The pressure gradients can become progressively stronger or weaker. This can be very helpful information for short-term to intermediate-term investors. While it is possible to smooth the readings (make them less volatile), doing so would reduce sensitivity. The indicator is relatively new (first introduced on 6/3/15). If we get enough requests for less sensitivity, we can modify it to accomplish that. We wanted to make the indicator sensitive initially because the high sensitivity suited our own purposes at the time. Computational details are currently proprietary.

The market has an effect on shares analogous to the effect of air currents on an airplane. The greater the speed of the wind against the direction of the plane, the more difficult it is for a plane to make headway. However, a plane moving in the direction of the wind will find it much easier to make headway and to gain speed. An airplane has its own driving force, but the plane’s environment exerts its external force on the plane. Likewise, shares have their own motion based on supply/demand and sentiment considerations pertaining to those shares, but the environment in which the shares exist exerts forces on the shares that are unrelated to the merits of specific shares within that environment. We refer to this “force” as the “Group Pressure Gradient.” A Group Pressure Gradient reading near zero might be compared to flying on a windless or near windless day, and a reading of 28 might be compared to flying with a gentle to moderate tail wind. To continue the analogy, let’s assume we are dealing with a scale ranging from -100 to +100. Then, a reading of 28 to 57 might be compared to flying with a moderate to strong tail wind, while a reading of 57 to 85 would be like flying with strong winds to gale level tail winds. Negative readings would reverse the above comparisons. Of course the analogy is not perfect because a pilot would not want to fly in gale winds, but we certainly would not mind investing in shares when the market is registering 57 to100 on the pressure gradient scale. Note: By the time you read this, we will be using raw scores, so readings will no longer be confined to a scale with boundaries between -100 and +100. The Group Pressure Gradient has both magnitude and direction. Hence, it is a vector. A river or stream has many currents, cross-currents, counter-currents, eddies, and minor whirlpools. If a person wants to know what the pressure gradients are in a stream, he must select a specific spot in the stream to conduct his measurements. The same thing applies to pressure gradients in the stock market. To measure a pressure gradient, it is necessary to select a specific group of stocks within the market. We are currently calculating this indicator for three groups of stocks: stocks in the Dow, stocks included in the Nasdaq Composite Index, and stocks that make up the S&P500 index (the last time we checked, the S&P500 consisted of 50.8% mid-cap, 45.4% large-cap, and the rest were small-cap). Measurements are not made for individual stocks in isolation. It is the general environment of the stocks in these groups that is being measured. Please be aware that some big-cap blue-chip stocks are in all three of our benchmarks (the Dow, in the S&P500, and on the Nasdaq), and each grouping has its own group pressure gradient. Therefore, when a stock is in more than one group, it is best to consider each environment but give the strongest weighting to that of the Dow (because the Dow has the greatest relative concentration of investors in blue-chips who also represent the biggest relative concentration of big money). If you are not investing in blue-chips, then you might give more weighting to the S&P 500. If you are investing in a portfolio of technology stocks, then give emphasis to the reading for the Nasdaq. Usually the groups have similar readings, but sometimes they are quite different. The GPG of a group may decline while the corresponding Index rises, or rise wile the corresponding Index declines. Also, individual stocks within a group can surge (because of a news event, for example), even when there is a negative pressure gradient. The indicator is extremely sensitive and can change dramatically from day to day. It might be best to think of it as measuring the current status of the pressure gradient. Earlier, we gave the analogy of an airplane flying with or against the wind. Bear in mind that air currents are constantly shifting in direction and intensity. An airplane often encounters gusts of wind. Similarly, this indicator will occasionally reflect “gusts” and reversals. In other words, the indicator can sometimes be volatile on a daily basis. After observing it for a few days, a general pattern may emerge. It may become evident that the indicator tends to show pressures more often in one direction than in the opposite direction. The pressure gradients can become progressively stronger or weaker. This can be very helpful information for short-term to intermediate-term investors. While it is possible to smooth the readings (make them less volatile), doing so would reduce sensitivity. The indicator is relatively new (first introduced on 6/3/15). If we get enough requests for less sensitivity, we can modify it to accomplish that. We wanted to make the indicator sensitive initially because the high sensitivity suited our own purposes at the time. Computational details are currently proprietary.

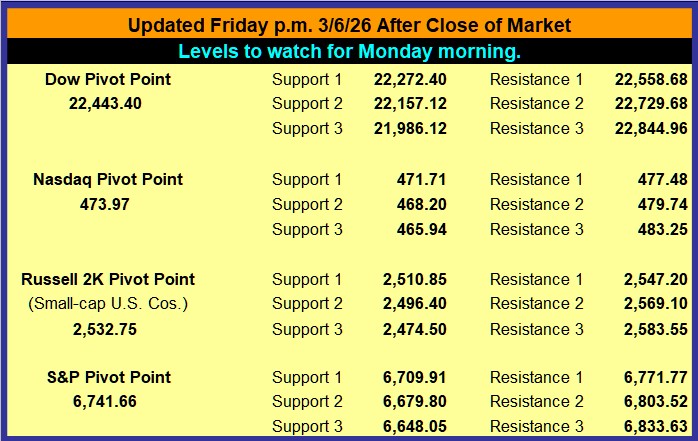

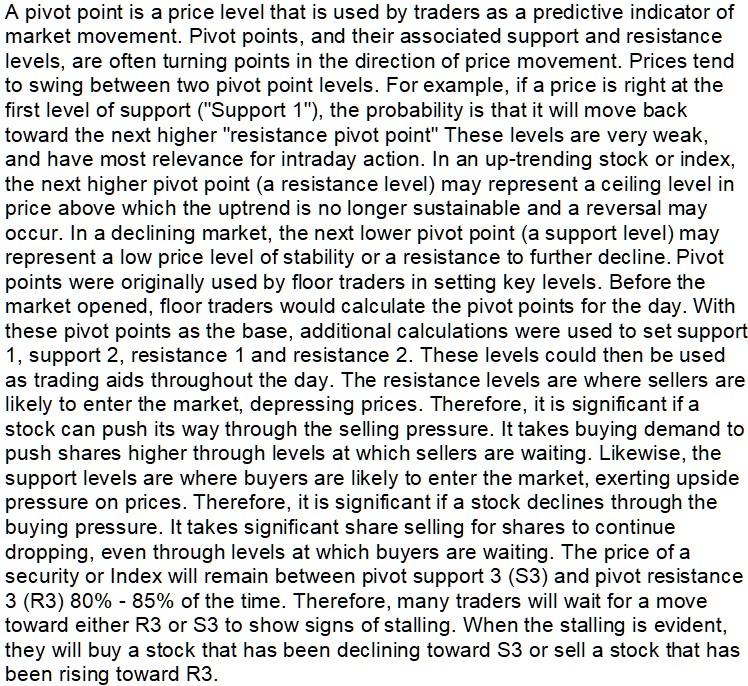

Pivot Points Pivot Point Explanation

Pivot Point Explanation

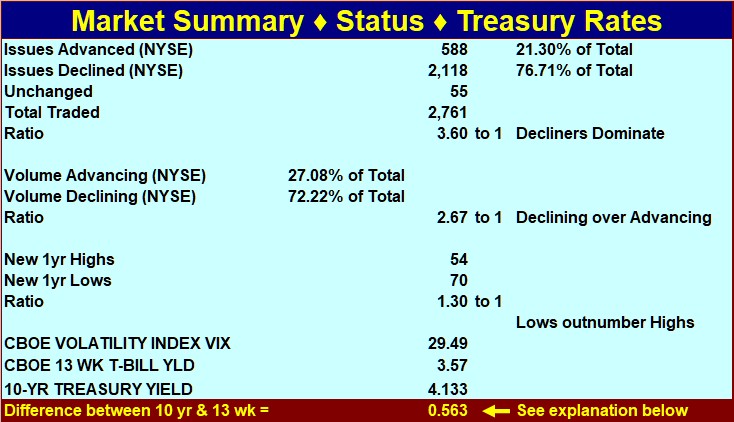

Market Status Report

Explanation regarding interest rates (see last line in above table).

Explanation regarding interest rates (see last line in above table).

When short-term rates are 1.3% to 2% below long-term rates, the difference is positive, and investors expect normal economic growth (2-3 percent per year). When the spread is greater, they expect even faster growth because the Central Bank is likely pushing rates down. This reduces the cost of borrowing for companies so they can expand capital investment. When short-term rates are higher than long-term rates, Central Banks are probably trying to curb inflation. Economic conditions are expected to deteriorate. When short-term rates exceed long-term rates by 1.5% or more, there is a 70% chance the economy will go into recession within the next 12-months. The foregoing can serve as an investment guide. If short-term rates are higher than long-term rates, tighten stops or take other protective measures. If they are 1% or more higher, consider moving to cash (the short-term curve was this far above the long-term curve in 2000 and a 3-year bear market began in that year). When short-term rates are less than 1% below long-term rates, stable growth stocks are attractive. When short-term rates are 1% to 3% less than long-term rates, stocks are even more attractive (a stock-picker’s market). If the spread is more than 3%, invest with the premise that inflation could start to heat up soon.

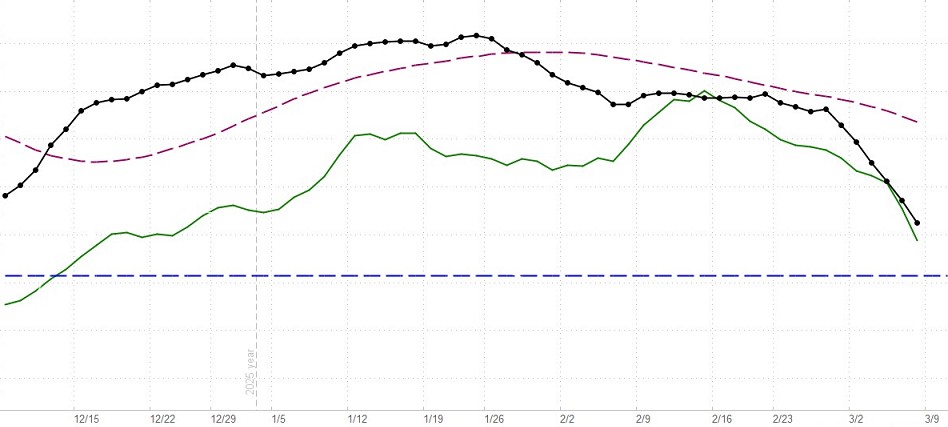

This is updated daily. When the black line with dots (the indicator line) is above the horizontal blue line, this indicator is telling us that the market has a positive or bullish bias (in the short-term to intermediate-term, even if not in the long-term). If the black dotted line is declining toward the horizontal line, bullish sentiment is decreasing but still present. A negative or bearish bias will be indicated when the black line crosses below the horizontal line.

Assume, that the market has a positive bias (the black line is above zero). If the green line is rising, it is confirming that the environment is supporting bullishness. In this case, long-term and intermediate-term investors who take bearish positions will be in an environment that is working against them. A declining green line in a market with a positive bias means the positive bias is not currently being confirmed … the MBI is detecting counter-currents of negative momentum that are not yet significant enough to change the market’s positive bias status. That means investors may find situations where bearish positions can be taken with somewhat less risk than when the market has a confirmed bullish bias, but because the general environment is bullish, there is still risk in taking bearish positions. Great caution is recommended. Money can be made only on carefully selected bearish positions taken by short-term or intermediate-term investor/traders who know how to trade bearish positions in a market with a positive bias. If the black indicator line crosses below the dark red dashed line, it means that the bearish sentiment is becoming more significant, but since the black line is still above zero, probabilities still favor bullish positioning. In this environment, carefully selected bearish positions are more likely to be profitable than before the black line crossed below the dashed line. From the perspective of an experienced short-term trader, the non-confirmed reading is giving a “go-ahead” for quick bearish trades. Here, the indicator would be giving nuanced information a level deeper than most indicators. If the market has a positive bias, a green line turning down merely means the conditions are not “optimal” for short-term bullish positions. That does not mean they cannot be very profitable if carefully chosen. However, a downturn of the green line in a market with a negative bias is much more problematic for bullish positioning, even for very short-term traders.

Assume, that the market has a negative bias (the black line is below zero). If the green line is declining, it is confirming that the environment is supporting bearishness. In this case, long-term and intermediate-term investors who take bullish positions will be in an environment that is working against them. A rising green line in a market with a negative bias means the negative bias is not currently being confirmed … the MBI is detecting counter-currents of positive momentum that are not yet significant enough to change the market’s negative bias status. That means investors may find situations where bullish positions can be taken with somewhat less risk than when the market has a confirmed bearish bias, but because the general environment is bearish, there is still risk in taking bullish positions. Great caution is recommended. Money can be made only on carefully selected bullish positions taken by short-term or intermediate-term investor/traders who know how to trade bullish positions in a market with a negative bias. If the black indicator line crosses above the dark red dashed line, it means that the bullish sentiment is becoming more significant, but since the black line is still below zero, probabilities still favor bearish positioning. In this environment, carefully selected bullish positions are more likely to be profitable than before the black line crossed above the dashed line. From the perspective of an experienced short-term trader, the non-confirmed reading is giving a “go-ahead” for quick bullish trades. Here, again, the indicator would be giving nuanced information a level deeper than most indicators. In a market with a negative bias, a rising green line is letting an investor know that if they are very careful, there are some opportunities. For example, a setup pattern could offer a good opportunity for a 1-week price surge [a pre-surge “setup” pattern is meant here. For more on these patterns see the bottom half of the Stock Alerts page on this site]. A swing-trader may take such a position to participate in the surge and sell immediately as the surge loses momentum. These trades can enable a person to capture a gain of maybe 3% to 12% and sometimes much more than that (we have captured more than 30% in a single day).

As for the green line, its position above or below either the black Indicator line (or Dashed red line) is not relevant. It is the direction of the green line, not its position, that is relevant.

The dashed red line can be used in combination with the black dotted line as a short-term buy/sell signal generator, but all signals must be confirmed by the green confirmation line. For example, say the black dotted line is below the horizontal line (indicating a negative market bias), and it crosses above the dashed dark-red line. If, at the same time, the green line is rising, then a cross above the red line may be interpreted as a buy signal in a negative environment for a short-term trade. All such signals must be viewed with respect to the prevailing context and the risks implied by the current configurations. Nothing on this Website should be interpreted as a buy or sell recommendation. Our indicators may generate buy or sell signals, but never buy or sell recommendations.

So, what if the Indicator line is above zero (indicating a positive bias), but it has crossed below the broken red line? If the green line is declining, it is confirming that bearish positions can be taken within the bullish environment. However, it must be remembered that risk is higher than if the market has a bearish bias. If the green line is rising, it is not confirming the short-term sell signal created by the Indicator line crossing below the red dashed line. Instead, it is confirming the positive bias indicated by the black indicator line’s position above the zero line.

On the other hand, if the Indicator line is below zero (indicating a negative bias), but it has crossed above the broken red line, simply reverse what was said in the above comments. This indicator is sensitive. For example, it gave a “sell signal” two days before the market meltdown in 1987. More information on MBI

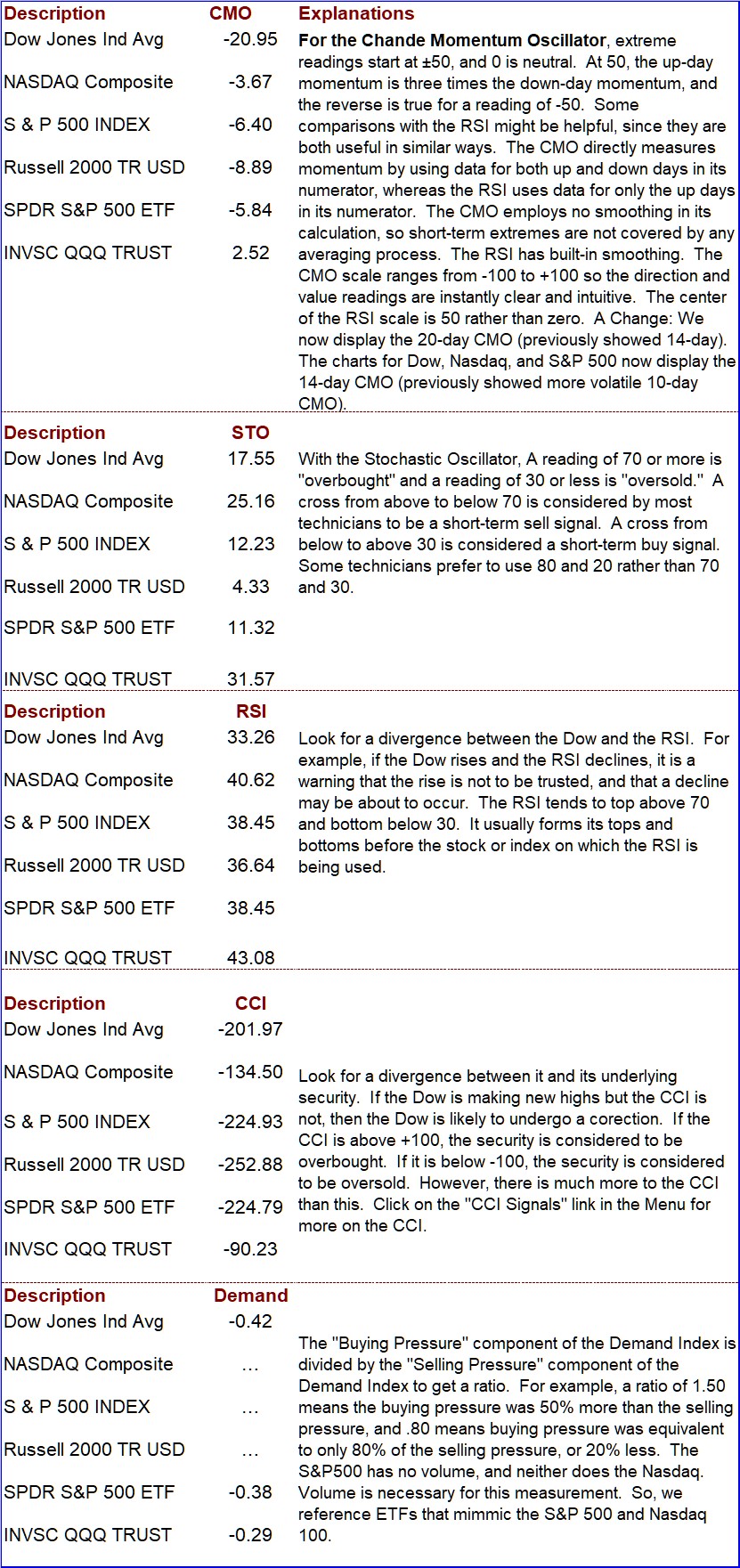

CMO, STO, RSI, CCI, Demand Index

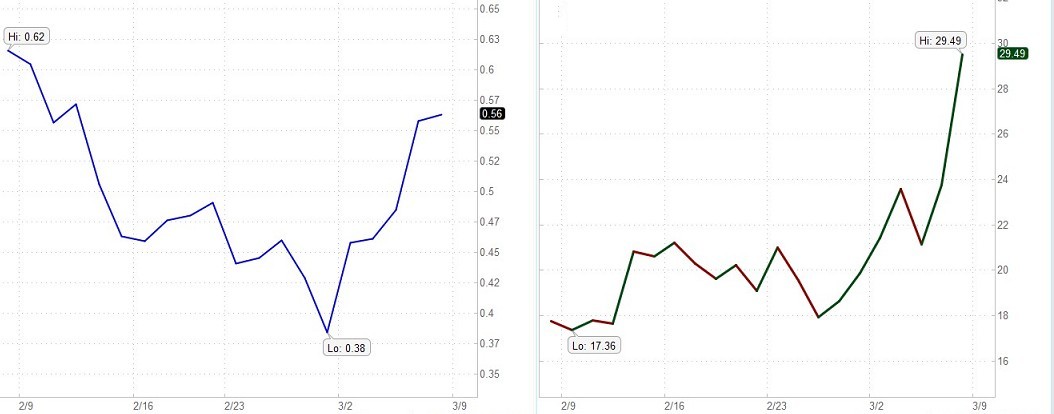

Interest Rate Spread (%) & VIX

Interest Rate spread The left chart above shows the difference between the long-term (10-year) and short-term (13-week) interest rates over recent months. When the spread between short-term rates and long-term rates is +1.3% to +2% (short-term lower than long-term), the economy is thought to be in for a normal growth rate in the vicinity of 2% to 3%. If the difference is more than that, it is probably because the Central Bank is making money more easily available and the economy will likely undergo accelerated growth. When companies can get cheap money, they can more easily afford to invest in projects, facilities, and equipment that will expand business or improve operations. If the interest rate spread is negative (short-term money more expensive than long-term money, then money is being made more difficult to obtain by the Central Banks (they are attempting to reduce the rate of inflation). This will, of course, slow down the amount of capital investment made by companies. Economic expansion will be mitigated. If the spread is a negative 1.5% (or even more), then the probability is 70% that economic recession will occur within a year. This information can be the basis for some general guidelines. If the spread is negative, make stop losses hug price action more snugly and use other techniques you may be aware of to guard or enhance assets in the event of market decline. If the short-term rate is enough higher that the interest rate spread is -1% or more, cash might be your best option. If the chart indicates that the current spread is .76, then the current spread is a little more than ¾ of 1%. The fact that the number is positive (the line is above zero) means the long-term rates are greater than the short-term rates. If the number is negative (the line is below zero) it means the short-term rates are greater than the long-term rates. a.) If the spread is negative, tighten stops or take other protective measures. b.) If short-term rates are 1% or more higher than long-term rates, cash might be a more appropriate investment (Remember that the bear market that began in 2000 started under these conditions). c.) When the spread between short-term and long-term money is less than 1%, higher-quality growth stocks are better candidates. d.) When short-term money costs 1% to 3% less than long-term money, stocks are generally even more likely to be profitable. A greater variety of stocks will advance in valuations. e.) If the spread is more than 3%, assume that inflation is just around the corner.

VIX VIX values greater than 30 are generally associated with a large amount of volatility as a result of investor fear or uncertainty, while values below 20 generally correspond to less stressful, even complacent, times in the markets.

A low VIX, a range of 20 to 25, indicates traders have become somewhat uninterested in the market and generally indicates a sell-off. The value of VIX increases as the market goes down and decreases when the market moves in an upward direction. A rising stock market is seen as less risky and a declining stock market more risky. The higher the perceived risk in stocks, the higher the implied volatility and the more expensive the associated options, especially puts. Hence, implied volatility is not about the size of the price swings, but rather the implied risk associated with the stock market. When the market declines, the demand for puts usually increases. Increased demand means higher put prices and higher implied volatilities.

For contrarians, comparing VIX action with that of the market can yield good clues on future direction or duration of a move. The further VIX increases in value, the more panic there is in the market. The further VIX decreases in value, the more complacency there is in the market. As a measure of complacency and panic, VIX is often used as a contrarian indicator. Prolonged and/or extremely low VIX readings indicate a high degree of complacency and are generally regarded at bearish. Some contrarians view readings below 20 as excessively bearish. Conversely, prolonged and/or extremely high VIX readings indicate a high degree or anxiety or even panic among options traders and are regarded at bullish. High VIX readings usually occur after an extended or sharp decline and sentiment is still quite bearish. Some contrarians view readings above 30 as bullish.

Conflicting signals between VIX and the market can yield sentiment clues for the short term, also. Overly bullish sentiment or complacency is regarded as bearish by contrarians. On the other hand, overly bearish sentiment or panic is regarded as bullish. If the market declines sharply and VIX remains unchanged or decreases in value (towards complacency), it could indicate that the decline has further to go. Contrarians might take the view that there is still not enough bearishness or panic in the market to warrant a bottom. If the market advances sharply and VIX increases in value (towards panic), it could indicate that the advance has further to go. Contrarians might take the view that there is not enough bullishness or complacency to warrant a top.

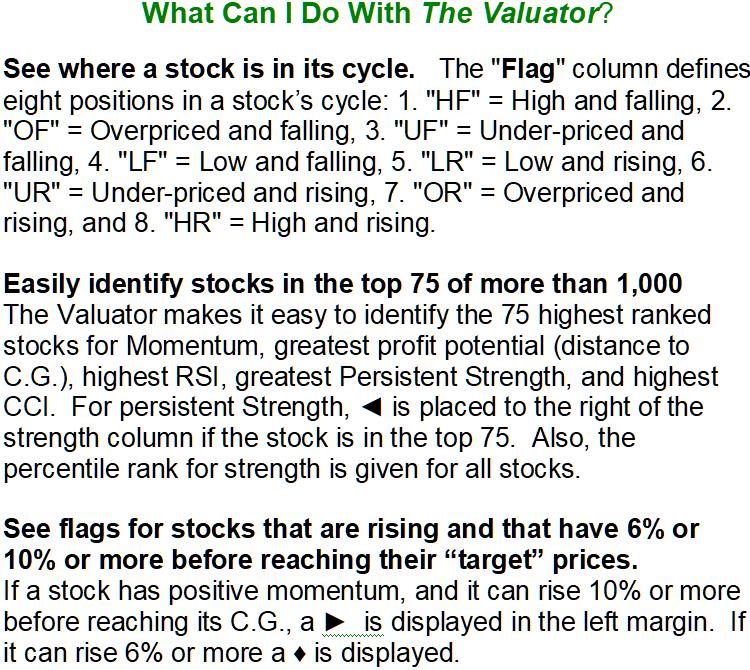

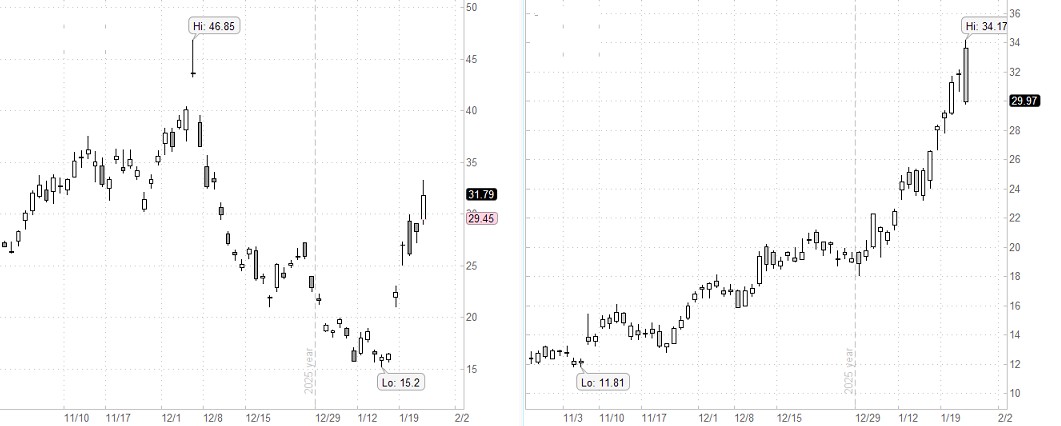

What’s In The Valuator?

Stocks With Highest Persistent Strength Ranking

See what this means

Stocks With Lowest PE-Ratios

Probable High and Low Price Range For Each Stock

Stocks With Lowest and Highest RSI

10-Day Momentum For each Stock

The ATR (Average True Range) For Each Stock

SETUPS: Increase your odds of making a profit by focusing on “setups,” chart configurations that are most often seen before a price surge. Be sure to wait for the “trigger event.” A “trigger event” is your buy signal, assuming there is not overhead resistance or other contrary indications. For more on setups, go the Q&A page and read item 13. Then use the link at the end of that explanation.

The Trading Result For One Of Our Traders

Long ago we proved to our own satisfaction (by trading with real money) that to obtain gains of more than 50% a year it is not necessary to invest in options, currencies, or commodities. It can be done simply by buying and selling stock. All you need is a good discipline (and that you actually follow your discipline). That is what this site is all about. We do not make a practice of revealing the performance of company traders. There is little reason to do so, and it is nobody’s business but our own. However, one of our traders has given permission for us to share her performance on a one-time basis.

After brokerage fees, her net return for the year was 58%. All she did to obtain this return was to buy and sell stocks in a very bad market. She simply cut losses quickly, focused on good setups, and looked for trigger events. When it was time to sell, she did not talk herself out of it or “argue” with the evidence. She also did not sit “glued” in front of her computer. She entered her trades and set her stop losses. Often, the only time she could check her positions was long after the market closed. She did not have to agonize about margined positions held overnight because they were not part of her discipline.

It might also be worth mentioning that to optimize liquidity, to minimize the spread between bid and ask, and for risk-control reasons, she prefers to avoid stocks that trade for less than $5. Most of the stocks she trades are followed in The Valuator. This trader is a very private person who does not want to report her returns every year, so there is no plan to update this performance in future years. This report was posted shortly after the data was available, and it will be left here for future visitors.

Please be aware that she did have major distractions during this year that almost certainly got in the way of her achieving a significantly greater return. In other words, this was by no means the best she could do. However, she allowed us to reveal her performance anyway in order to encourage others and to show that returns above 50% are achievable (even under less than ideal conditions). [Portfolio returns above 50% per year can be achieved by trading relatively high quality stocks priced above $5 in a cash account.

The discipline used by this trader is extremely low in risk, much lower than the risk assumed by the average mutual fund investor or the buy-and-hold investor in individual stocks. Yes, she could have achieved a much higher return if she had kept her positions highly leveraged. She does not wish to take that route. Greed destroys discipline. Here is a little known fact worth considering. 80% of the people who fully leverage their investments in the futures markets eventually lose all their money. Some people do well in the futures markets. The same can be said for some who trade penny stocks and currencies. However, it is not the use of leverage that makes a winner, but the use of a good discipline. Too many people don’t get that fact.

The discipline used to achieve the above return is our own creation. We do not make it available to the public as part of any service or training program. In other words, we are not providing this performance information to solicit your enrollment in any kind of program. It is provided only to encourage people to be diligent in the development of their own discipline. We will leave this report here to encourage others who may be wondering if working at developing a discipline is worth the effort.

========================================================

Silver – Gold – Platinum – Paladium

According to the source for the following, the spot price of gold is determined by the London bullion market twice a day – at 10:30am and at 3pm – London time (2:30 am & 7am Pacific time).